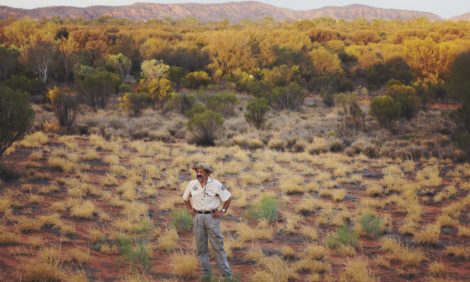

Standing together in solidarity

On Friday 15 March, I watched with growing horror as events unfolded in Christchurch. My immediate concern was for those in the Mosques, as well as friends, family and Xeros we have down south. As the days went by, my thoughts turned to providing meaningful support to our wider Xero whanau and the Christchurch community.… [Read the full article »]