Contractor improvements in Xero Payroll

Xero Payroll now makes it easier to set up and manage contractors, process contractor pay, and deduct withholding tax. The improved payroll experience for contractors includes:

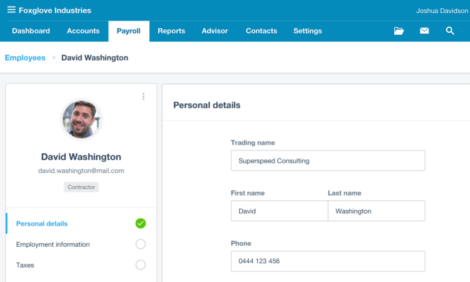

- a new seamless workflow for setting up contractors where you enter only the required details, including whether they’re GST-registered, and nothing more

- automatic calculation of GST on earnings for GST-registered contractor payments

- automatic update of the GST return once a pay run is posted.

How does it look in Xero Payroll?

For the steps to follow, see setting up a contractor and processing pay for a contractor.

Contractors are free until 31 July 2018

To celebrate this enhancement to Xero Payroll, all contractors who you pay using the new workflow between now and 31 July 2018 will be free.

So make sure you take full advantage of this limited time offer by moving your contractors over to the new workflow as soon as you can.

From 1 August 2018, the standard $1 per employee charge will apply.

Managing contractors already set up in Xero Payroll

Any existing contractors you have set up in payroll will need to be transitioned to the new workflow by 31 July 2018. To learn more about what the updates mean for organisations with contractors already on Xero Payroll, and how to set up those existing contractors, watch our webinar recording or take a look at our FAQs.

The post Contractor improvements in Xero Payroll appeared first on Xero Blog.

Source: Xero Blog